(First posted 10/29/2016)

Almost five years ago to the day we reviewed and opined on potential future powertrain options for mass transit vehicles in the US – let’s see how our predictions have held up over time – and what the future looks like now….new information in a postscript.

We’ve recently looked back and explored some of the classic makes and models of motor coach transportation in North America. And thanks to others such as our good friend Johannes Dutch, we’ve also been enlightened with in-depth and informative articles on coaches from Europe and other areas. There are still plenty of classic older buses to highlight, but Jim Klein’s superb overview of his recent trip on the “Bustang” made me think that it might be a good time for a look ahead, rather than the past. So let’s see what may be in store for bus riders in the next several decades.

Our first trend attempts to leverage all the benefits of light rail, without the single main disadvantage – cost. Bus Rapid Transit (BRT) is becoming ever-more popular and uses large, high passenger-load coaches, designated lanes, automated right of way at intersections, elevated stations that allow for platform level entry, and off-board fare collection – all to make the bus riding experience more enjoyable, easier, and quicker.

It is growing in popularity – and as Paul has commented on, has even spread to our founder’s bucolic hometown, Eugene Oregon.

Buses are typically articulated models, usually with two sections, though sometimes more. Currently, most use diesel power, though as we’ll see below, other options are catching on…

BRT seems to work best when a comprehensive transportation system is already in place to feed passengers into the BRT corridor. Without that, ridership can sometimes fall below projected levels. But because it can use existing roadways reconfigured for bus lanes, it is significantly cheaper than light rail. We’ll likely see it continuing to expand in the future…

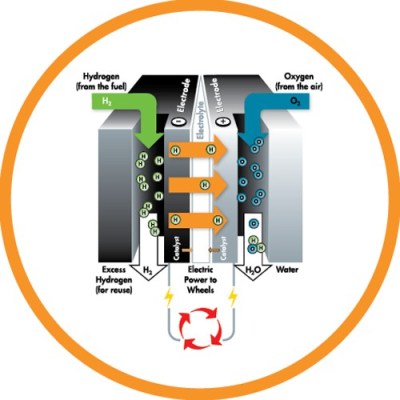

Other future trends are related to power trains. Currently, clean diesel and compressed natural gas (CNG) are the two major fuels used to power buses. In the US today, about four-fifths of new transit capital purchases are diesel, the remaining fifth CNG. But both emit some emissions, and with ever tightening government standards, other technologies are being brought to the forefront. One in small-scale test and evaluation since the mid-2000s is hydrogen fuel cells. Fuel cells take hydrogen, stored in on-board cylinders, and run it through a converter which separates the atoms through electrolysis, sending electricity to batteries and motors, with water as the other byproduct.

Fuel cells have several advantages; the system provides more energy at the driven wheel than an equivalent diesel-engined bus. Moreover, it’s a true zero emissions solution – the only thing that comes out of the tail pipe is water. It also provides a range similar to diesel – about 200-250 miles between hydrogen refills.

But there are some significant limitations; the biggest being expense. Fuel cell technology itself is costly, as is the infrastructure to sustain it. Based on a study by California-based AC Transit in 2010, cost of operating a diesel fleet was less than half (41%) of one with fuel cell coaches. Most of this cost was in building the hydrogen delivery and storage infrastructure, but the coaches themselves were also more expensive to acquire and maintain. A variety of companies and cooperatives, with government support, are working to advance this technology and bring these costs down.

One such company is Toyota – which as I’m sure readers here know, began marketing its Mirai fuel cell sedan in the US in 2015, and in other markets this year.

Toyota also recently debuted a new fuel cell bus – not surprising as its Hino subsidiary has been experimenting with large fuel cell coaches, showing one at the 2015 Tokyo Motor Show.

The other major power train trend is battery-electric propulsion. Battery-electric buses face the same two hurdles as all vehicles with this motive power; range and recharging cycle time. As we’ve seen with Tesla, over the past twenty years, battery capacity and recharging options have seen steady incremental improvements. A typical electric bus today has about a 170 mile range between a full and non-usable charge – the BYD “Lancaster” bus above, showcased at the 2015 American Public Transportation Association (APTA) Expo in Houston, is an example.

The key variable however is recharging cycle time – today, there are two general methods being evaluated that will provide for rapid charging of urban transit buses (versus taking a coach out of service for a long, 4-6 hour recharge). First is inductive or wireless charging. Here, inductive coils or wires are implanted into roadways or at specific quick charge stations and buses receive a charge wirelessly, without any direct connection. This system shows promise, but currently the transfer rate is still fairly low.

The other, more promising method, is for buses to receive a quick charge from an overhead charging station via catenary wires or a pantograph. Both Siemens, the large German-based industrial conglomerate, and Opbrid, a Spanish company, are testing new high-powered pantograph charging systems that provide a 90% recharge in 3-5 minutes. Such a system may work well at terminal end points where these short recharging layovers can be factored in to the overall route schedule.

I’ll offer a prognostication – my guess is barring some breakthrough in clean diesel/CNG technology or hydrogen delivery and storage, battery-electric will become the primary motive option for future urban transit buses.

Postscript:

Well, it appears our prognostications were fairly accurate – with a little fine tuning.

The switch from internal combustion (IC) engines to those with zero emissions has continued, though perhaps at a slower pace than we anticipated. At the end of 2020, a Dept of Transportation analysis concluded that of the 155,000 urban transit and para-transit vehicles in the US, only two percent were zero emission. Most bus fleets in the US continue to have legacy IC engines.

Pure battery-electric vehicles (BEV) are still the leading Zero Emission Vehicle (ZEV) candidate. While only several BEV buses were offered in 2016, almost every coach manufacturer today has an electric model in their lineup, and almost all of these have stated they will convert to all-electric by the end of the decade. This past August, German bus and truck manufacturer MAN, part of the VW group, stated it would begin phasing out its bus diesel powertrains in favor of all-electric ones beginning in 2024 – they estimate nine out of ten new bus purchases in Europe by 2030 will be BEV. Government clean air mandates have certainly influenced this trend. Additionally, as with electric cars, buses have experienced a similar advancement in range and charging time. The current Proterra ZX5 has a range of 329 miles, and several other manufacturers are predicting models with a 500 mile range in the near future. In China which has over 400,000 electric buses in operation, models with light ultra-capacitors rather than heavier batteries are in operation. Though they have a range of only 25-35 miles, they can be re-charged very quickly, with overhead charging stations at regular stops.

Fuel Cell Electric Vehicles (FCEV) have continued to offer an alternative to BEV, but the obstacles of cost, reliability, and limited infrastructure remain. Because of their complexity, FCEV are still more expensive on a per-unit basis than a BEV. Further, a recent study by AC Transit in California showed that their FCEV buses (outside of warranty) had a 56% in-commission rate, compared to 96% for diesel, and 82% for BEV. Hydrogen infrastructure has also not expanded at the same rate as electric. But for locations that lack an BEV-supportive electrical grid and infrastructure, FCEV will remain an option.

Lastly, at least for mass transit vehicles, clean diesel, diesel-electric hybrid, and CNG powertrains, while predominant now, are operating on borrowed time and will increasingly become a niche product.

If it isn’t already, it seems pretty clear that the bus you take to the office, school, or shopping over the next few years will be all-electric…

As an alternative to internal combustion, don’t forget the longer-ranging trolleybus. Naturally there are disadvantages such as the wire network & route inflexibility.

yeah, for BRT using a fixed route, how expensive is it to run the catenary wire and be able to use existing trolley bus technology (and fewer vehicles because you don’t need vehicles to operate in place of the ones being charged, even if charging is fairly quick)

The non barrier divided bus only lane seems like wishful thinking, even street running trolleys shared their tracked lanes with cars. Eugene’s right of way setup (at least in that particular stretch) looks much more foolproof, but I imagine pretty costly, at least in the short term.

As for the propulsion, while electric definitely should be the way to go, and I’m going to be called a Luddite for saying this, overhead wires > batteries/fuel cells, ect. Sorry. What works works and what may work is, again, rooted in utopian thinking. Only thing overhead wires have going against them is aesthetics(not to me though, but I like seeing infrastructure), and maintenance cost, but I suspect the latter will be a wash with the development and maintenance of future technologies, whether by fuel cell or inductive charging.

There’s a big difference between trolleys, light rail and BRT. Trolleys run right on the streets and share them, but that’s becoming increasingly problematic, due to the traffic getting worse and many drivers not knowing how to share the street properly with a trolley. Trolleys make some sense in the heart of high-density downtown areas, where distances are short, but are no faster than buses, so no advantage except for nostalgia. And lots of additional expense with the wires.

Overhead lines are very expensive to install, require maintenance and are very ugly. They’re really not going to be relevant in the future as both fuel cell and battery tech improve. Even new light rail will probably do without overhead lines in the future.

BRT splits the difference between trolley/bus and light rail, using the existing right of way in parts and its own in others. The system in Eugene has been a major success. We have two BRT lines running and are constructing a major new third line, and a fourth is in planning. For a city the size of Eugene, light rail was just not in the cards, money wise. But BRT is turning out to be the Goldilocks solution.

Yes, I know all about your Luddite tendencies. 🙂

I should clarify I more question the installation of BRT in place of an existing trolley/light rail type system, which wasn’t really brought up but historical context popped in my head and I rambled on as I also have a tendency to do lol. Starting from scratch in an expanding city or working within dismantled infrastructure is a different story, it always baffled me why old trolley lines running in their own medians and branched off right of ways in some cities weren’t immediately converted to bus only access for example. I just think an unbarriered bus only lane, in the second picture rendering, is the wrong way to go about it. Cars are going to be in it at some point for left turns, many especially during rush hours, jamming up busses just as they do currently in non dedicated lanes. Trolleys, yes, faced the same dilemma but they weren’t trolley only. I know the notion is that drivers can’t possibly cope and learn to deal with sharing roads with mass transit, but I think that’s a defeatist attitude. Towns keep on plopping EU style roundabouts randomly into American cities where most drivers ed programs give ZERO insight towards, and people figure it out just fine, this is no different, just another vehicle.

I remain skeptical of the disadvantage between the wires and the new systems, wires need maintenance, yes, but it’s quick accessible maintenance and the power transfer is direct and efficient. Looking ugly is in the eye of the beholder, I’d way prefer seeing overhead wires in a city than graffiti murals and other urban art, but it is what it is. The new technology won’t be maintenance free itself

BRT is NOT designed to replace an existing trolley/LR system. No one is doing that or suggesting it. It’s simply a cheaper alternative to a new trolley/LR system. Much cheaper. Which is why no overhead lines. It’s all about the cost.

There’s lights at intersections which keep left-turning cars out of the bus lane. No problem.

It’s definitely cheaper in the short term, in as much that the core investment is creating the pathway for busses, but as much promise as the future holds technology wise there’s still a very unproven track(no pun intended) record for the charging systems proposed, and who knows what idea may come next. And since they’d ultimately become infrastructure, that can be very costly to chance once in place if there’s another big leap afterwards, rendering what’s being ooh and aah’d at now obsolete. LRT with wires is a technological dead end, which is a good thing, there’s no grand revelation to turn the technology on it’s head, with maintenance( an inevitability no matter the technology) it’ll work forever.

The curbed ROW aspect of Eugene’s system, at least what I see of it here, is definitely the smart execution of it, but I live in Chicago, and the looplink BRT system is a joke. They painted a previously all access lane red, choking traffic for CTA busses only, and they get inundated with charter busses, cabs and other cars because there’s no barrier preventing it.

Much depends on design and execution – in Haifa, Israel, they replaced a myriad of bus routes crisscrossing through downtown with one BRT line (https://en.wikipedia.org/wiki/Metronit) with _partly_ (!) dedicated lanes and it was initially a disaster, with travel times actually becoming longer; in many cases they neglected to allow BRT priority on traffic lights, those who live further away need to take feeder lines to connect with it and so on. As noted above, it can work but only if it’s properly integrated with other public transport modes.

Pretty fascinating! The inductive charging “stations” at pickup and drop-off points seem like the way to go. That way the bus is almost always charged.

The Eugene setup looks a lot like a 1970’s carchase movie ramp. Driver swerves right and stomps on brakes to avoid a kid; right wheel jumps the ramp, left wheel dips into the soft mud zone between the tracks. Tipover.

If they were trying to instantiate the famous “Trolley Problem” moral conundrum, they’ve done a good job.

Yup; we’ve had two or three of them tip over like that, and a few dozen people killed in the process, but hey, progress has its price! It’s pretty spectacular though, seeing them go airborne before they come back to earth upside down. No great loss; bus riders are all losers anyway, right?

I got about halfway through that before I was 100% sure you weren’t serious…

Cough, https://electrek.co/2018/04/06/electric-bus-rolls-over-crash-new-flyer/, Cough….

That was during testing. The driver went off the edge of the road and “lost control”. Whether the batteries on the roof contributed to it rolling over is not a black or white situation.

Ultimately, it was an issue of operator error, possibly exacerbated by the high CG.

They changed the ESC programming to help avoid that, and since then, they’ve introduced a whole new EV bus that has lighter batteries and are packaged to reduce the CG.

No worries; no passengers have been harmed by tipping EV buses.

Fort Collins has a similar system to Eugene’s called the MAX which was placed to run near and parallel to our main NorthSouth corridor. It mostly has right of way like a train and can and does force cross traffic to stop. Most of it has a dedicated “road” with barrier bars that stop other traffic from entering.

The problem in our instance is that the route is bordered on one side by College Ave (HWY 287) which is very heavily trafficked, Mason Street on the other (lightly trafficked), a major freight rail line between them and now this. So within 1/4 mile there are now FOUR potential impediments to the East/West traffic at several major intersections. This can and does cause some severe issues for the East/West traffic when the lights and gates somehow all concertina one after the other.

The main other issues have to do with it not running on Sundays and not running late enough at night, but those are fixable.

We also have a separate normal bus line that runs all over town in tandem with this. The MAX didn’t really seem to solve anything, it is causing new problems. I’m guessing it was built with a lot of federal dollars that would have gone away otherwise but on the whole (from my own perspective, I can’t speak for everyone), it seems deeply flawed.

Great article though, the different propulsion techniques are very interesting and seem to be foreshadowing the possibilities for individual transport as well – inductive charging for one is now starting to come on the scene for electric cars.

Sounds like a design with inherent compromises. We have two lines in Eugene, and they’re both unqualified successes. A major new third line heading west from downtown is in construction, which has been controversial because of the construction impact to the business along West 11the avenue. But once it’s done, the business will only benefit. A fourth line is in planning.

None of our lines run in a situation similar to what you’ve sescribed. Folks (conservatives/business owners) bitch about it before hand, but there’s zero negativity about it after it’s up and running. It’s really had quite a major positve impact, and lots of students ride it to the university.

Bus Rapid Transit is an oxymoron.

The one in Eugene has cut down travel times by a pretty good margin. It scoots right along on its little runway between stops. Bus Semi-Rapid Transit?

Well to answer your question as regards to Eugene: our transit system is awaiting delivery of seven BYD battery-electric buses. These are not BRT type buses,just conventional street buses. It will be interesting to see how they pan out.

I totally agree with your conclusions. Electric buses is the future, and with ever-improving batteries, quick/induction charging, etc., that’s obvious.

Our BRT system would be perfect for rapid/induction charging, as the buses have a bit of a wait time at the end of each of their runs. I suspect thta will be be what happens here eventually.

Interesting how the author is mainly interested in the emerging technology of fuel cells, which show real promise and might be best introduced in these fixed-route, local services that won’t require more than a single filling station. But he ignores the proven 19th Century technology of steel wheels on rail, which would seem an obvious cho

ice here.

I feel sorry for the drivers who will have to hold the wheel straight for the whole distance, then execute a u-turn and go back the same way. Sure, they may be automated away soon, but that still leaves you with energy-wasting pneumatic tires and their rolling resistance. The system pictured is running on a dedicated roadway with shallow ruts to direct the path. Why not go all the way to real rail transit?

Because it’s a whole lot less expensive. Since the money to pay for the construction of these come mostly from the feds, and lots of folks are already uptight about so much money of their tax dollars being spent on mass transit projects, if you can reduce the cost by roughly 50% or more, than the answer is pretty obvious.

Yes, I’ve always found it interesting how people completely oppose the very idea of public transit that can benefit everyone. Very few people seem to grasp that it is not a stretch to envision a scenario where one simply cannot drive themselves anymore for any reason even at a young age, be that economic, health (break your right leg or damage your knee and you’re a passenger; same with losing your eyesight or any number of other issues, etc), or just convenience, as in a large city. As a bonus, less drivers on the road means a clearer road for those that can drive.

As a result, in general, the US as a whole has a very bad public transit infrastructure setup with it being unlikely to ever improve overall and everybody complaining about traffic and the lack of road capacity.

The practicality of a universally beneficial public transport network starts with zoning: where people live, & where they work. Problem is, for decades the Prez. & Congress encouraged single-family home ownership, while at the same time they help finance transit systems which work best for high-density urban zones. Sounds like a mixed message!

for decades the Prez. & Congress encouraged single-family home ownership

They did push home ownership, but the benefits (tax deductions for mortgage and federally-backed loans) were equally available to those buying a stand-alone house or a condo/apt. Urban sprawl is something the feds can’t really control; it’s strictly a state land use issue and local zoning.

Oregon was the first state to have a comprehensive land-use law, and the result has been much less sprawl and denser cities more easily served by transit.

Hello John – just FYI, I didn’t ignore rail – I just focused this post on bus alternatives. I happen to be a fan of light rail, trolleys, monorails – really all forms of mass transportation. But as Paul has pointed out, light rail is tremendously expensive; the right of ways, the rail beds, the trains – all make it at least four times if not more expensive than a BRT system.

And no matter how extensive the pre-construction ridership studies, its all a “roll of the dice” on whether folks will decide to ride or continue to drive

I would say electric buses are the way to go with zero emissions. We’ll be getting some Chinese models up here next year. Tests during the past year have shown they work fine in a cold climate and and are reliable.

Edmonton and Calgary have good LRT systems with Calgary’s system more mature and I think better thought out. It is costly however if you’re going to put it underground as Edmonton has found our over the years. I think Vancouver putting the Skytrain on an elevated rail is the better and cheaper way to run the LRT. Plus, less interference with vehicular traffic.

Yes, elevated rail works well and is more cost effective in certain locations. I’m working on a post now on the several elevated railway systems here in Tokyo. Jim

In Auckland my sister uses the park n ride system with its own dedicated motorway lane, the only issue appears to be greatly underestimated popularity resulting in a lack of parking spaces at the terminals, but it is a much faster way of getting to and from work with out the parking charges. The buses are double decker diesel powered which I will go for a ride on next trip up there the top deck looks like it has a great view.

I may be a little cynical, but it seems to me the main advantage Bus Rapid Transit has over regular buses is that it doesn’t LOOK like a bus, so it avoids a lot of the “Loser Limousine” stigma that keeps riders away…

The you are more than a little cynical. 🙂

The main advantage is speed, hence the name. That’s due to fewer stops, signals synchronized with the bus, and limited access roadways at least part of the time.

The faster transit times do have the effect of making it more attractive, hence more ridership. But yes, the big buses and special stops do make it also more attractive.

Well thanks Jim, now I’m up to date with the latest developments. I kind of lost track since I rode buses in the eighties on an almost daily basis. The yellow regional buses and the purple city buses. Same colors throughout the country.

Below an example of a public transport bus as they drive around here now. It’s a MAN Lion’s City that runs on CNG or any form of bio-gas (that’s gas, not gasoline).

Thanks Johannes – that’s a nice looking bus. Jim.

Look up CT fast track for a little bit of an oddity. The service is pretty good as the line is on it’s own right of way with few crossings. They managed to do that by building on an old rail line. The trouble is the route is not ideal for pulling commuters and it was hugely expensive (several estimates put it very close to light rail) Now it is being used and ridership isn’t bad but the costs were so huge that many in local government are still heavily against it.

It also has issues where several of the towns it passes thru have areas near the line that could be developed in to fairly high rent apartments and condos (old rail line equals old unused industrial sites rather then apartments currently one of the issues) but the local communities are blocking them, which will again hamper growth on the line.

As a rail guy I was initially against but reading about BRT success in places like Eugene I got excited but I think the route they choose was rather poor.

I’m not a fan of electrifying all autos, but I well remember from bike riding in NoVa summers and living 3 years on King St the horrible noise, smell, and added heat of diesel city buses, so electric ones should be a great benefit to big city living and probably worth the cost and trouble. But they may need a man with a flag proceeding them to avoid running over sheepy pedestrians (and scaring the horses).

BEV buses are on a roll, and their market share is growing very rapidly. Out transit district has only ordered BEV (battery) buses in the past some years, and there’s now a number of them on the streets. They’re committed to going 100% electric.

Fuel cell buses, like fuel cell cars, meanwhile have gone nowhere so far in the US. Japan and Korea are very invested in that technology, and the Europeans leaned that way, but they’re now much more oriented to batteries (in Europe) at least for the time being.

Fuel cells may yet have a real role, but not until green hydrogen (made from water via solar cells) becomes common. Creatng hydrogen from natural gas as is currently mostly done is not really a solution.

Here in the Minneapolis/St Paul Minnesota we are adding more BRT routes. We also have LR routes, one that is currently under construction, 14.5 miles for more than TWO BILLION dollars!

Our first line managed to stay some what in its budget by cutting back on the number of trains AND the size of trains, 4 cars vs 6 cars and also cutting back the size of the station platforms. Of course after the line was up and running Additional trains were bought and we are back to 6 car trains which required some construction at ALL the stations to EXTEND the platforms.

It would look to the curious person that the light rail lines appear to be more of a Property developers dream than actually moving people. This route managed to bypass around a large urban area population. Our first line connects sports stadiums, downtown Mpls, the airport and The Mall of America. Also this line failed to cross a river that would have made it a real commuter benefit. Then they located the service facility midway along this route so adding and removing cars is very inconvenient. This results in dragging around cars adding wear and tear plus additional wasted energy.

In Minnesota we tend to do a half ass job to get something because we don’t want to spend the money, then we go back later and fix the stupid stuff we did because we were to cheap to do it right in the first place.

I have commented in the previous article about the electric vehicles. I remain sceptical about the benefit of electric vehicles for a several reasons. One reason is the enormous difficulties in putting out fire, especially the battery fire.

The public transportation operators in Germany have withdrawn the entire BEV buses and parked them in the area where the potential fire would not destroy the structure or other buses.

The massive fire caused by BEV bus at the depot in Stuttgart earlier this month was the proverbial straw that broke the camel’s back. 20 buses were burnt down to the skeletal remains, and the building was extensively damaged.

In June, 8 buses along with the charging stations were destroyed in Hannover following the electrical fire from one of the BEV buses.

In April, 38 buses in Düsseldorf bus depot were destroyed.

All of them were traced to the certain Mercedes-Benz BEV buses. Yet, the public transportation companies withdrew the BEV buses regardless of manufacturers as the precaution.

Even though people would say, “oh, it’s same with petrol and diesel, too.” Well, they can be put out quickly while the battery fire is much difficult to put out with current firefighting technology. Amsterdam developed the water tank to dunk the electric cars as to deprive the batteries of air.

I am not wholly convinced of electric vehicles and current battery technology yet. I don’t appreciate the environmentalists and green political parties putting so much pressure on eliminating the ICE vehicles without considering the alternative fuels such as hydrogen, biofuel from waste food-grade oil, and such.

They also tightened up the emission control regulations, making it more difficult for the manufacturers to meet despite the fact that the ICE vehicles are much cleaner than they were even ten or twenty years ago. How far must the governmental agency continue to push for the stricter and stricter emission control regulations that have no benefit when the aviation, heavy ships, and like are allowed to pollute as much as they “humanely” can? Why single out the automotive vehicles?

I believe in freedom of choices and in having the alternatives than BEV.

Fires and electrocution is something EV’s are going to have to deal with.

Emission controls were always a bit curious to me. In our state there was a cut off for emission testing based on the GVWR of a vehicle. If your car failed, no tabs for you. Yet the delivery truck or garbage truck that is running on 7 cylinders doesn’t have to pass any test. Diesels? Forget about it. Seemed business was the major benefactor of these exemptions. Locomotives, ships, I’m almost bet power plants were tighter regulated for years.