EPA’s 2021 Automotive Trends Report is out, and as usual, it is a treasure trove of statistics. I’m going to dive in and extract some key charts and summaries, as the whole thing is a bit much, although I do recommend reading it to properly understand the impacts technology and consumer preference have made on real-world fuel economy.

This is the single most important chart, as it sums up the story so far, since 1975. The plunge in weight and hp and the concomitant increase in fuel economy directly after the two energy crises is stark. 1987 set a record in fuel economy that would not equaled for two decades (2008), by which time weight and hp had increased substantially. Since then, weight has stayed roughly the same, but hp and economy continue to increase, thanks to technology improvements.

Of course economy would be significantly higher if weight had stayed at 1987 levels, but consumers have voted with their preference for larger and heavier vehicles, back roughly to 1975 levels.

We need to get terminology out of the way first, as it’s not necessarily logical. The sedan/wagon class is largely self explanatory, and includes all sizes of sedans/wagons, hatchbacks, two-seaters and such.

SUVs fall into either the car or truck category depending on some rather arbitrary metrics. Most 2WD SUVs with a GVW (gross vehicle weight, meaning maximum loaded weight) of 6,000 lbs or less are categorized as cars, while most with 4WD or GVW in excess of 6,000 lbs are considered trucks. This is of course rather silly, as it means that essentially all Subarus are trucks, as one example). Given that over 50% of all vehicles now have 4WD and the preponderance of that in SUVs, the number of car SUVs is quite limited. But that’s how it works.

This chart shows the changing percentages of production share and fuel economy of these five categories. Contrary to popular myth, the share of pickups of the whole market has not really changed much, since the overall market has grown so much over the decades. But then neither has their fuel economy since 1980, as that undoubtedly reflects the change in the composition of the pickup market, which once had a large percentage of compact models, and the full size ones have grown in size, weight and features (on average). Other categories have shown larger improvements in economy.

This shows the distribution by vehicle type by manufacturer, arranged from left to right according to CO2 emissions, which is of course a direct reflection of fuel economy. GM, Ford and Stellantis unsurprisingly are all at the far right.

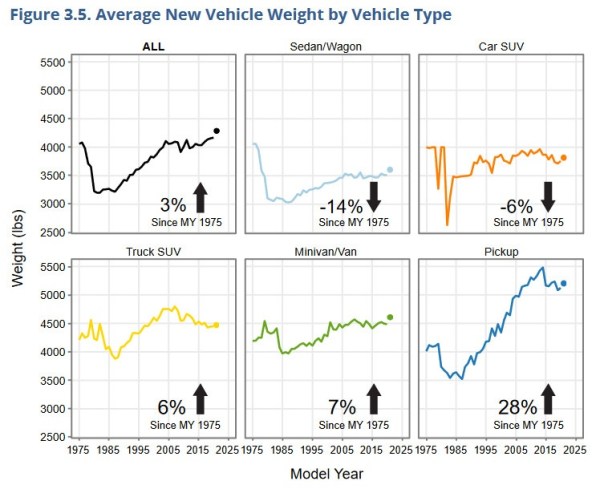

We see here that pickups have had the biggest weight problem since 1975. Again, the decline of the mini/compact pickup segment is undoubtedly the biggest cause, along with the increase in crew cab models, 4WD and feature creep. Note that there has been some reduction in the past few years, thanks to Ford’s aluminum body, other efforts at weight reduction, and an increase in the “compact” pickup sector.

Pickups have also had the biggest increase in hp since 1975.

It’s important to point out that massive increases in maximum hp does not directly correlate to comparable decreases in economy, thanks to dramatic technology improvements. This chart shows that was much more the case in 1978 (dark blue) compared to 2020. Nevertheless, there is a correlation, and it and higher weight have directly contributed to greater CO2 emissions (worse fuel economy).

Of course all that increase in hp has had a concomitant effect on acceleration. Average 2020 vehicle 0-60 time is 7.8 seconds. In 1981 or so, peak “malaise”, that appears to have been about 16.5 seconds, so the decline since then is fully over one half. Once again pickups had the biggest decline.

Here’s a more detailed listing of some of these categories year-by-year.

Technology has of course been the sole driver of improved economy, given the growth in weight and hp. Here’s a chart showing the various primary technology types and their adoption by manufacturers.

Self explanatory.

This one is interesting, showing the changes in key metrics for gas engines. It shows the drastic improvements in hp/displacement and consumption/hp, whereas consumption/ displacement has changed very little. But then that last metric has less relevance, given the proliferation of down sized engines. The average engine size in 1975 was 300 cubic inches; it’s 170 cubic inches in 2020.

The growth of gas-electric hybrids is growing again, after a lull.

The growth of EVs and plug-in hybrids has of course accelerated strongly in the past few years. Fuel cell vehicles are still an extreme minority.

This chart shows the EV range has increased on average, now very close to 300 miles. That number seems a bit high to me, but EV sales are dominated by Tesla, and most of them do achieve that or greater range. The efficiency of EVs has been increasing too, and not by an insignificant amount.

This chart shows the EV range has increased on average, now very close to 300 miles. That number seems a bit high to me, but EV sales are dominated by Tesla, and most of them do achieve that or greater range. The efficiency of EVs has been increasing too, and not by an insignificant amount.

Diesels are hanging in there, but with barely more than a 1% share of the market, and almost exclusively in pickups and truck SUVs.

4WD has grown from less than 10% to well over 50%. Now if we only had a statistic as to how often it actually is utilized.

4WD has grown from less than 10% to well over 50%. Now if we only had a statistic as to how often it actually is utilized.

This is just the tip of the iceberg, so help yourself to the rest of it here.

Excellent article that covers a lot of ground. Imagine what mpg and emission gains would

Have been like if hp growth had been curtailed? Regarding awd/4wd I think it can have

Major benefits depending on where one lives. Is it a necessity, no but it helps dispense

With having to seasonally switch tires, keep a bunch of weight in the back of a rwd vehicle,

Etc.

Very interesting, a lot of data here, and there is a lot of variability in interpretation and conclusions, in my opinion.

Chart 4.2, Emerging Technologies: , “GDI”. Is that Gasoline Direct Injection? What is “CD”?

I find it interesting that Toyota generally has a lower usage of the “emerging technologies”, These can have drawbacks. Toyota is perceived by many as the best quality/most reliable automaker. In 2021, it was also the number seller in the USA.

I’ll have to check out the report link. Thanks for sharing here!

Yes, GDI id direct injection. CD is Cylinder Deactivation.

A basic 1975 Chevy 2WD half ton had a 4.1 liter six that produced ~105 hp. I can’t find figures, but I think that truck weighed 3200-3500 lbs. It got about 15mpg.

My basic 2002 Chevy 2WD half ton has a 4.3 liter six that produces 200 hp, almost 100% increase! But it weighs closer to 4500 lbs. Guess what? It still gets 15mpg.

But I assume my truck is faster. It also has EFI, ABS, overdrive, 4-wheel disc brakes, and an FM radio!

My 2020 Chevy Colorado 3.6 V6, 4wd, 8-spd auto, weighs about 4400 lbs. During the past year, it has averaged 18.2 mpg, with a low fill-up of 14.1 mpg and high of 24.9 mpg. This is real data, miles driven over fuel purchased. The trip computer is close, sometimes spot on, but sometimes 1 mpg optimistic.

It makes 310 hp, 270 lb-ft. It’s pretty quick.

So when I drove a 2008 Silverado 5.3 4WD for about a year, I marveled at how it averaged 17mpg (admittedly, it was 80% interstate at about 70-75mph, but per computer, which was with 0.5mpg, I could get 20mpg at 67mpg), with 4WD, and weighed FIFTY PERCENT more than my mother’s 75 Pontiac Ventura, which weighed 3599 lbs, per the registration. 260 V8. It got about 15mpg.

And the Silverado was quick, with power to spare.

First thought: That ‘diesel mountain’ of cars back in the 80’s is almost entirely GM, and a graphic reminder of just how badly their engines failed.

Second thought: Do we really need a 200% increase in horsepower, given than fuel economy/displacement has only slightly improved? Makes me wonder what we could have accomplished with only 100% improvement.

But a 200% improvement is just so fun!

Mostly the reason was diesel fuel prices dramatically went up.

I’m surprised the pickup share was so stable, with more people having both work and Sunday trucks. Was the blip up in ’93 caused by tax changes?

It seems like there should be a bigger increase in sedan weight than shown in the last 30 years due to crash standards and size increases.

Oooh, lots of stats and graphs to geek out over!

A couple of random thoughts – the significant decrease in weight for cars/wagons (alone among the categories) is probably due to that being the category most constrained by CAFE for much of its existence. Also, lumping vans and minivans together in this chart is not that helpful, as “traditional” vans had more in common with pickups than with cars before 1983 (outliers like VW aside), certainly as of 1975. Minivans alone have ballooned in weight far more than this graph would suggest.

It is interesting that none of the emissions charts show anything other than CO2 – which was the one that was not considered a problem until fairly recently. I would suspect that the emissions regulated in 1975 have all decreased to negligible levels in comparison.

The weight of sedans/wagons crashed between 1975 and 1981 grossly in excess of the change in CAFE those years. It crashed because of rising fuel prices, which was the final coffin nail in traditional big/medium big American cars. We’ve covered this in “Who Killed the Big American Car?” 1974 was the beginning of its final death throes that had started in 1958.

CAFE didn’t take effect until 1978, by which time sedan/wagon weight had already plummeted.

I know you like to blame CAFE, but there were much bigger forces shaping the car market at the time.

1978, by which time sedan/wagon weight had already plummeted

Then average weight must be weighted by production. Were the hp figures also?

I had a summer job in 1980 with the Energy Information Administration of the DoE. They were paying contractors to make surveys of household energy efficiency and usage. To measure air infiltration, they would set up a fan on front door openings. It would suck the soot out of chimneys and deposit it around the house, which did not go over well with the homeowners.

Then average weight must be weighted by production. Were the hp figures also?

Yes, all these figures are production weighted. There’s no way cars individually shed all that weight in a few years. People switched to buying smaller cars for their better efficiency.

Yes, on the hp figures. All the stats are production weighted.

All true – CAFE didn’t accomplish anything in the early years as the market was rushing in the same direction – rewarding smaller size and greater efficiency. But when the market turned back the other direction starting around 1985, the law put a bigger drag on larger, heavier passenger cars than it did on trucks and vans. I don’t claim it was the only factor, but it was a factor.

You have demonstrated that tastes were moving away from larger cars, but it remains that cars and car-based SUVs were the only categories to go down in weight from 1975 – I do not see it as coincidence that those are the two categories most heavily hobbled by the CAFE system after the rest of the market started moving back to larger, more powerful vehicles. After all, that was the purpose of the system. It just didn’t work as intended because the market rushed to trucks (including minivans) and the net effect is that my minivan weighs the same as a 73 New Yorker. It is just faster and more efficient. 🙂

But when the market turned back the other direction starting around 1985, the law put a bigger drag on larger, heavier passenger cars than it did on trucks and vans. I don’t claim it was the only factor, but it was a factor.

Take a good look at this chart from my post on that subject. After being quite stable between 1980 and 1984, Big RWD car share plunged 66% from 14.5% in ’84 to 6.5% in ’86, in two years!

Please explain that, in light of your opinion about the influence of CAFE. And note that the CAFE standard actually decreased for cars between those years, from 27.0 mpg in ’84 to 26.0 mpg in ’86.

It had essentially zero to do with CAFE. The big cars between ’84 and ’86 didn’t get feebler; on the contrary, hp numbers were trending up in these years.

What did happen? The market in these years was suddenly dominated by boomers who could afford nicer new cars to replace their little tin cans from the late 70s and early 80s. And what did they buy, in vast quantities? Ford Taurii, Caravan/Voyager, Jeep Cherokee, Chevy S-10 Blazer, Accords, etc.. And of course pickups and bigger SUVs were growing in popularity, because they were…the in thing, for boomers and some older buyers.

The change from traditional sedans and wagons to other types of cars was analogous to changing fashions: men stopped wearing hats, and then suits except to work; women stopped wearing gloves and getting dressed up to go shopping, etc..

Boomers were not in the slightest interested in old-school RWD cars by 1985. Yes, there were some outliers, and I know you have a passion for big barges, but that does not reflect the reality of the market then.

It wasn’t CAFE; it was the changing tastes of the market.

We’ve had this same conversation/debate dozens of times over this past decade, and I guess I’ll never convince you, even though I specifically wrote that article for you.

The sharp rise in the price of gasoline in 1979 affected consumer behavior, and the fall of the year marked the start of a recession. These factors increased demand for smaller cars in general.

Americans were not as obese then, yet our “large American bodies” did just fine with cars like Chevettes, Tercels, Accords, Escorts, X-Cars, and K-cars.

CAFE affected the domestic automakers directly by forcing them to start factoring MPG into their vehicle designs. Ironically, this helped them out.

by forcing the domestics (painfully) to shift to smaller cars at a time when the market wanted that.

Of course, it boomeranged with the truck loophole.

Personally, I have never liked CAFE. It’s like mandating medium size clothes, when most people want large.

An honest government ruling a generally informed, aware, and intelligent public would have raised fuel taxes to reduce consumption, and use the money to fix the roads, for constructive public investment, and to reduce other taxes. My views are idealistic, I know.

Your view is clear-eyed and firmly based in reality. CAFE was the American auto industry’s own loophole-riddled alternative to the prospect of grownup-style motor fuel taxation, which bore giant amounts of juicy fruit for the industry in the form of enormous sales volume of enormously profitable SUVs, long subject to no CAFE requirements because they’re “trucks”, now subject to much laxer CAFE requirements than cars because they’re “trucks”. We’d’ve been much better off doing it the way the whole rest of the civilised world does it: fuel taxation. Buy whatever vehicle you want, as long as you can afford to feed it.

I have zero sympathy for any simpering about the industry “struggling to meet CAFE”. It really was their own petard, and that’s the charitable view; the realistic view is that the whining and excusemaking was purely performative: Can’t sell you a Caprice Estate any more; the big, bad government CAFE law made us stop. Here, have a look at this lovely Tahoe.

Yeah Daniel thats why I drive a large roomy 5 door car with a diesel engine 6.2L/100km average mix of city highway 0-100 dont really know but traffic gets in the way on motorway onramps it exceeds our open road speed limit in the 3 top gears so performance is adequate.

The United States has been the world’s economic powerhouse, and much of that success is because Americans are free to travel, visit shopping centers and buy goods, go out to restaurant’s, visit friends and family, go on vacations, sight see, and of course go back and forth to work. The engine that drives this success is reasonable fuel prices. Compare with Europe, where they tax fuel to death, Europeans don’t travel at the same scale as we do. They don’t generate a gigantic economy like the United States.

Europeans don’t go back and forth to work? Interesting; what do you imagine they do instead? (Peter would like a word with you about that). Europeans don’t have freedom and don’t go on vacation? Um…that’s so far opposite of correct that it folds in on itself and no light can escape its event horizon. Europeans don’t go to restaurants, don’t go visit friends and family, don’t go shopping, don’t go buying goods? C’mon, now.

And that’s without even addressing the difference between American infrastructure—crumbling, falling apart, and decades past due for replacement bcuz god said thou shalt not tax—and infrastructure in ~Western Europe, where public money buys public goods and services. I’ll be the first to admit I don’t live in Europe, but I’ve been there quite a bunch of times (you?) and it sure seems a lot more like they’re taxed to life, not taxed to death.

And that’s without even addressing the fact that Europe is only one part of the rest of the world, which is full of other examples that give your argument a hard time.

The causes of this country’s infrastructure issues – particularly related to mass transit – are far more complicated than an unwillingness by Americans to pay higher taxes.

Outdated procurement processes, a fixation on shiny new projects with minimal consideration of long-term maintenance costs, a lack of cooperation among key agencies, our eminent domain laws and unions in bed with local and state politicians are some of the culprits: https://www.city-journal.org/why-cant-new-york-control-its-infrastructure-costs-16036.html

There are also the differences in population density. The population density of Germany, for example, is almost seven times greater than that of the U.S. In areas where we do have dense population, we do have extensive mass transit systems (New York City and Philadelphia, for example). But here in Pennsylvania, once one gets beyond Philadelphia and Pittsburgh, large-scale light rail is not feasible.

These graphs pretty much illustrate my exact situation.

My 1986 VW Jetta weighed pretty much 1000 kg and got 8L/100 km in the city and for some reason, the same on the highway. It had 90 hp and 0-100 km/h time of roughly 13 seconds.

My 2018 Golf SportWagen weighs 1450 kg, gets the same 8L/100 km in the city and 5L/100 km on the highway. It has 238 hp and 283 lb/ft of torque. The 0-100 km/h time is about 6.5 seconds. The midrange power is ferocious and wheelspin limits the 0-100 time.

We have 50% more weight, the same or better fuel consumption and more than 2.5X the power.

The old days were’t always so good!

I envy you all of that. I’d say ask me about the 18 L/100km city fuel consumption of my ’07 Accord that has a closely- and repeatedly-verified lack of anything the matter with it, but I already told all about it.

My TL never did better than 14L/100km so I know of what you speak. My Golf is faster and uses almost half the fuel, although both require premium fuel.

THe figures would be very different here almost all pickups are diesel and so are a lot of cars Mazda makes a diesel for its larger vehicles though the engine is almost biodegradable, Toyota has been in the diesel car game since forever, EVs are quite popular as are hybrids An Isuzu 4 wheeler whispered past me at a traffic light yesterday with pure EV signwriting on its curtains so EVs are invading the medium commercial market, the sales yard for such trucks is opposite the back entrance to our container transport yard I should look more closely but being based in the tanker yard I dont go there much.

So weight is up a little bit overall, power and fuel economy have each almost doubled. (per the first graph). Electric (including hybrid, PHEV, full EV) vehicles are mostly heavier than their ICE equivalents and obviously hugely more fuel (oil) efficient so perhaps they account for the actual total fleetwide weight increase.

Trucks meanwhile are far larger, yet significantly more efficient and also significantly more capable than in 1975 and generally more capable dynamically in every measurable objective aspect than whatever large sedan or PLC they supplanted in addition to replacing the interior space, if not even having much more. A full size truck can do the work of many of the older heavier classes, especially in regard to towing as well as keeping up with current speeds on the highway and hills, even when loaded, and can do so reliably well into the six-digit mileages with generally minimal repair. It’s practically common to see 200k+ miles on a decade old pickup, not so with a 1975 fullsize Buick in 1985. The current midsize trucks are better than many of the full sizers of yore. The new minitrucks are a very welcome and very nice niche but clearly not as profitable as larger ones so will be (are?) artificially constrained production-wise. The volume from those will come when other manufacturers that don’t have a huge truck profit center (i.e. Ford) to favor get into the game and take away some of the pie.

Could it be better? Sure. But the (our) public has spoken by actions that they aren’t interested in small cars or at least not enough to pay for them while providing anywhere near the same level of profit to the manufacturers, so they mostly aren’t sold here anymore while notably are still available and sold in huge numbers elsewhere in the world that has fuel prices at twice or more our levels by the same manufacturers that don’t offer them here.

All of the improvements (fuel economy, power levels) seem to be continually increasing, perhaps at a lower rate than they could, but increasing nonetheless.

All true, of course, but it leaves out the uncomfortable fact that the big trucks and SUVs we love so much on this continent are a much greater lethal menace than cars (of any size) to pedestrians, bicyclists, motorcyclists, and others. This is one of the big reasons why American traffic-related fatalities are trending worse while in pretty much the entire rest of the first world they’re trending better.

Whatever, that all has zero to do with the focus of the article (I didn’t read the link which may well delve into that) which seems to show that despite increases in vehicle size and power, fuel economy continues to improve and little things such as cylinder deactivation, stop/start, other tech both new and old etc can have very large results when taken as fleetwide total impacts. That’s what I got out of it anyway, I may have misinterpreted things.

North America has issues significantly worse than traffic-related fatalities in terms of fatality numbers that could be easily reduced if there was any societal will to do so. Guns, Covid, Opiods, take your pick, at least two of which are also often a cause of death due directly to someone else’s action. And most (all?) are also significantly lower in other more or less comparable countries. Cars/Trucks/SUVs are far down the list in order of importance to say nothing of overall impact if only one problem were solved/eliminated entirely.

Pardon me, Jim; I didn’t mean to upset you or rile you up. Never mind!

Distraction from using mobile phones likely part of the uptick. Cumbersome touchscreen and other un-ergonomic controls adding to it, but those are just as common in other wealthy countries.

…other wealthy countries that use the UN (formerly “European”) vehicle regulations, which contain stringent pedestrian-protection requirements completely absent on the North American regulatory island.

It’s not just drivers who are distracted by cell phone use. Pedestrians are distracted, too. I’ve had to remind my 12-year-old daughter – no cell phone use while walking, particularly in parking lots.

When I’m out and about, it’s not just pre-teens and teenagers I see trying to walk and text/talk at the same time.

Weirdest thing here for me is the collapse of V8 engine percentages in 1980 to less than half of what they were the year before. I can’t recall that big a shift away from 8 cylinder engines that year.

@LA673 those numbers don’t lie. In the summer of 1979, the price of gas doubled, to over $1 per gallon. Big hit. Then that fall, the economy went into the biggest recession since WWII. High unemployment and inflation, and the Iran hostage–that’s why a politician many derided as “just an actor” or a “cowboy” became President.

Until summer 1979, all carmakers were having a good sales year. Sales crashed late in the year, 1980 was a big drop.

In this new, smaller market, small cars made up a bigger share than ever. There are your 4-cylinders. Larger car sales continued to drop–there are your V8s.

At the beginning of 1979, two of America’s biggest sellers featured six-cylinders, but a good size percentage had V8s: the Nova and Aspen/Volare. In 1980 the X-car had completely replaced the Nova, and it was 4 cyl/V6. The Aspen Volare sales were down. Thunderbird (all V8) sales had crashed, and in 1981 Ford would offer a joke of replacement, an ugly version of the Fairmont. These cars themselves didn’t move the whole market, but represented the action in the middle. Even GM’s downsized mid-sizers (the 1978), which were popular in my world, half had V8s. But in 1980, most of the much lower total were V6.

In 1979, inflation picked back up again. The price of a base Fairmont went from $3663 in 1978 to $3800 or so in 1979 (about 5%). In 1980 it jumped, increasing during the model year to I think $4500 or $4700–over 25% more.

Those are some interesting (and not positive) parallels to today–the biggest being inflation.

Of course, then inflation was measured more honestly than it is not, so today’s inflation is understated, and now belatedly the Fed recognizes “we have inflation”. In 1979/80, we had high prices, but no shortages.

I’m not car shopping now, but 2020, in hindsight, may have been a good time to lease a car, or better yet a truck.

Low interest rates, decent prices–if one scored a low monthly payment NOW, when the lease ends in 2023, that used car, or better yet truck, will be worth a lot more than the lease buyout price. So if your lease car has a dent or two, don’t worry, the dealer will take it. If you tell the dealer you want to buy it, they will probably pay you to give the car back (either outright cash or apply toward another vehicle). Especially trucks!

And just as 1980s marked the end of V8 dominance, with GM’s announcement that they will really ramp up EV capacity, the 2020s might mark the rise of EVs.

One observation–it’s interesting that the best run company, Toyota, seems to eschew a lot of innovations (or irritants) but does well executing. And they are now number one in the US (but without much fanfare).

True all that.

Toyota’s hybrids were certainly innovative. Honda and others had hybrids as well, but only Toyota went all in on them – yesterday’s announcement of the redesigned Sequoia adds to their hybrid-only models which include the Sienna, Venza, and (of course) Prius, plus many other Toyota and Lexus models with available hybrid powerplants. Hybrids may not be hip and trendy anymore now that several full EVs are available, but they still play an important role allowing those for whom EVs are not yet practical (namely rural dwellers who need to drive long distances or urban dwellers who park on the street and have no place to plug in for a long time) to reduce fossil fuel use via partial electrification.

The Fairmont-based T-Bird debuted in 1980 not 81, as did the similarly unpopular second-generation Cordoba.

Beautiful, beautiful graphs to digest. As a person from a metric land where we exclusively use fuel consumption (l/100km) rather than economy (mpg), how do you have a 90% increase in economy? What’s that trying to say?

Anyway, look at that 0-60 time graph and the trend is down! Tyres are consumables anyway!

The link to the 155 page report was appreciated. That report was fascinating. I was surprised to see that turbochargers have hung around in sedans, not showing major growth since about 2013. There was a little growth blip in there but has settled back down.

At one time, turbos were seen as “the” thing in engine technology trends.

Having said that, turbos have really captured a healthy and growing share of the trucks and large SUV market.

Graphs are on page 49 in the link.

https://nepis.epa.gov/Exe/ZyPDF.cgi?Dockey=P1013L1O.pdf